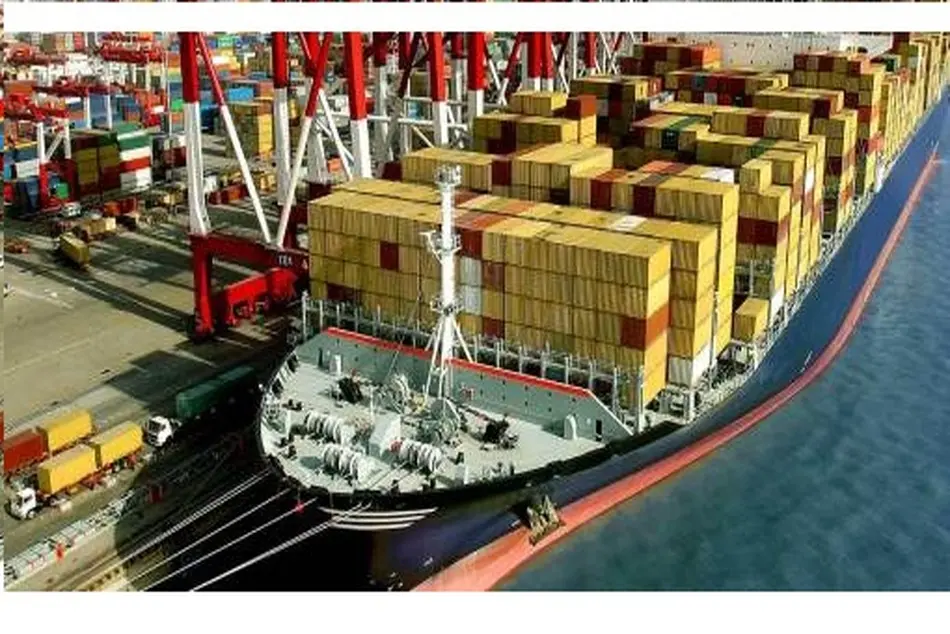

Middle East freight rates for petchems to come under pressure

Freight rates for petrochemical cargoes loading from Middle East are expected to come under pressure as a result of lacklustre demand for spot tonnage, according to industry sources.

The current bearish conditions will continue into the third quarter amid a slowdown in the Chinese markets and an increase in the number of tankers available for deployment.

Ship owners globally will be taking delivery of at least 45 newly built vessels in 2017 from shipyards in northeast Asia. Some of the new vessels will be used for trading in the West while others will be serving the Middle Eastern and Asian region.

The global chemical fleet grew by 5.2% in 2016 and is expected to expand by 3.3% in 2017. This will continue squeezing rates on major routes over the next two years, according to Hu Qing, lead analyst for chemical shipping at consultancy firm Drewry.

As part of their expansion program, major shipping companies such as Navig8 and Odjfell SE, are actively placing orders for energy- and cost-efficient new buildings at shipyards in northeast Asia.

However, demand for spot tonnage will continue softening in the third quarter as northeast Asian supply of key feedstock materials such as benzene, toluene, xylenes, paraxylene (PX) remains ample amid plant expansions and start-ups in 2016-2017.

China, a key importer for Middle Eastern petrochemical cargoes, has been steadily reducing its reliance on imports due to a combination of economic slowdown, high debt levels and overcapacity for some chemicals.

Market analysts forecast a decline in Chinese demand growth for key chemicals due to lack of manufacturing and capital investments.

Currently, chemical volumes moving from the Middle East to northeast Asia have slumped, with most market players expecting the trend to continue into the third quarter because of ongoing turnarounds at major refineries in Japan, South Korea and China.

Freight rates for chemical tankers in the Middle East market will continue to struggle to find a bottom going into June and July as trading volumes and liquidity traditionally decreases during the holy Muslim fasting month of Ramadan, which ends with the Eid ul-Fitr festival.

Ramadan started on 27 May in Asia and the Middle East.

On the other hand, some petrochemical tanker owners remain optimistic about prospects for the rest of the year even as the number of new vessels outpaces the increase in tanker demand.

They expect China’s One Belt, One Road initiative would improve demand for infrastructure material, and increase petrochemical tanker usage.

“After the summer lull and completion of refinery maintenances in China, South Korea and Japan, traders would start purchasing Middle Eastern cargoes which would boost chartering activity,” a ship owner said.