BWMC postponement is not an insurance, PANASIA says

In an exclusive interview with GREEN4SEA, Paul Jinhwa Kim, Manager, Panasia Europe BV, shares his concerns over the ballast water market after MEPC 71 and anticipates increased demand resulting in increasing retrofit cost. Therefore, he advises operators to prefer retrofitting BWMS by 2019 to benefit from low prices in all sectors.

GREEN4SEA: What do the decisions made during MEPC 71 actually mean for the BWMC? What are the biggest challenges towards BWMC implementation?

Paul Jinhwa Kim: Decisions made during MEPC 71 absolutely means that the demand and date of retrofit become finally unchangeable. There are a number of ways to anticipate the size of market. Of which, I want to take the capacity of annual vessel scrapping as a main criterion.

Due to financial difficulties, owners will definitely face pressure not to increase their fleet size. In this case, owners have two options regarding BWMS retrofit: installing BWMS to extend usage of existing vessels or to scrap vessels to substitute them with new vessels in order to be ready not only for BWMS but also for Scrubber system and others.

If we have the annual amount of BWMS retrofit and vessel scrapping, we can easily foresee the actual amount of BWMS retrofit.

Scrapping amount in 2014 was 22 mGT (million gross tonnage) and became to 28mGT in 2016 according to UNCTAD data. And total accumulation of world Gross Tonnage from 2000 to 2013 is 842 mGT which can be approximately split into five years to meet IMO BWMC D‐2 schedule as follows (vessels built from 2014 to 2017 are considered as BWMS equipped vessels from newbuilding stage).

| D-2 | Total Gross Tonnage |

| 2020 | 175,280,156 |

| 2021 | 185,269,598 |

| 2022 | 186,687,789 |

| 2023 | 175,624,076 |

| 2024 | 119,621,863 |

| Total | 842,483,482 |

If we assume annual scrapping capacity as 30mGT, the following Gross Tonnage shall install BWMS in the described year.

| D-2 | Total Gross Tonnage |

| 2020 | 145,280,156 |

| 2021 | 155,269,598 |

| 2022 | 156,687,789 |

| 2023 | 145,624,076 |

| 2024 | 89,621,863 |

| Total | 692,483,482 |

As a result, the biggest challenges towards BWMC implementation will be

- Demand will be highly concentrated increasing retrofit cost.

- Scrapping cannot be the option for all so that 85% of owners shall install BWMS.

- No one makes sure if annual total BWMS retrofit demand can be covered by world’s repair shipyards or not so all responsibilities will be owners’.

G4S: What experience have you gained so far with your BWTS installations? How important are the system redundancy and design for the BWTS installation and retrofit?

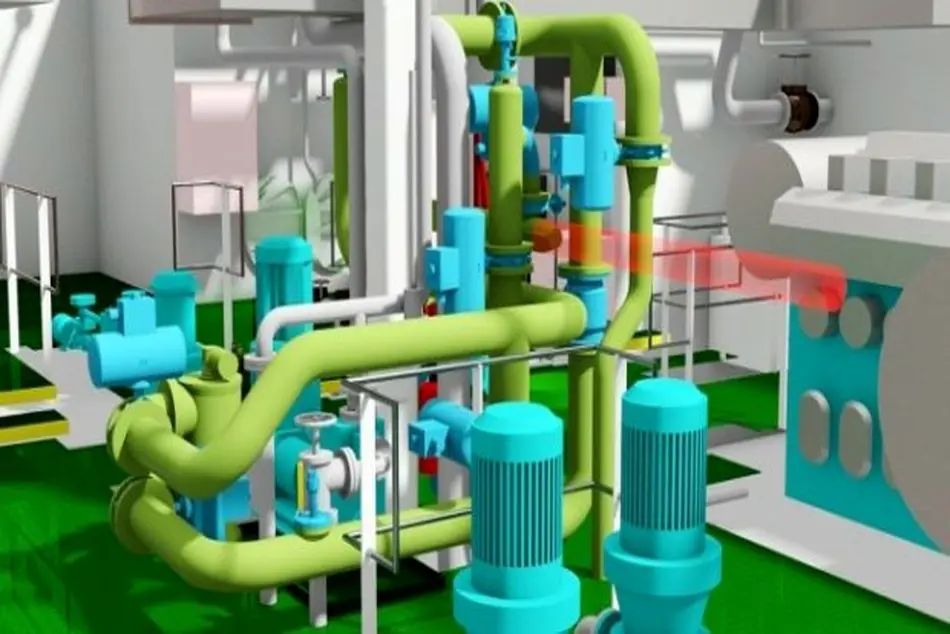

PJK: In terms of redundancy, it is recommended to install two BWMSs for two Ballast Water pumps but it is very rare to see the case due to doubled cost. In UV technology, it is instead applied that mega filter that can cover two Ballast Water pumps by a single unit is installed as 1st treatment, and two small UV chambers for two Ballast Water pumps are installed as 2nd treatment. Therefore, owners can operate two Ballast Water pumps with cheaper cost acquiring redundancy benefits on UV chambers.

G4S: What are the challenges of a BWTS retrofit installation and in what way does the new system affect the ship’s operability? What is your advice to optimize the process?

PJK: In our experiences, it is so hard to acquire skillful repair shipyard in this BWMS retrofit field. Lack of skill must not be neglected since this brings longer installation time and larger manpower input thereby increasing total retrofit price.

To back up this insufficiency, owners can be instead dependent on skillful supervisor who is well known of technological check points, features of BWMS, most efficient sequence of installation and manpower input calculation.

However, one supervisor cannot be talented to several types of BWMSs, and there are no many BWMS suppliers with appropriate amount of retrofit experience. Therefore, it is highly recommended that owners have to choose supervisor who are fully specialized with one or two BWMSs with experiences.

G4S: Regarding the training needed on board for the BWTS, what do shipowners need to think about the crew and their understanding of these systems and their installation? What is your advice and experience so far?

PJK: It is surprising to know the fact that large number of crews do not learn operating manual of BWMS in detail and do not have regular practices on board but it is extremely critical that crews or chief officers must be fully ready for BWMS operation. Of course, troubleshootings, maintenance, spare management, and document management for PSC inspection must not be ignored.

And frequent crew change‐over can cause knowledge leakage from one crew to the other mainly due to lack of time and efficient educational material.

To overcome this, it is recommended that technical managers in HQ firstly take intensive education on BWM at regional training center where real BWMS is ready for all types of education. Fully learnt technical manager can be the center of education passing down the knowledge inside company.

And it is also recommended to possess Computer Based Training (CBT) software on board for crews to have repetitive education on operation of BWMS with manual as a reference.

G4S: Do you foresee any emerging problems concerning the safety of the BWTS installed onboard? What is your advice to both operators and crew?

PJK: Owners must be notified about the fact that if PSCO inspection takes the 3rd step “indicative sampling” due to clear grounds found from 1st and 2nd steps, this proves the vessel is at its high risky status not since BWMS cannot pass indicative sampling but this means crews are managing documents badly, do not know how to operate the BWMS well (Not trained), and are unable to react against any alarm or trip situations.

The more steps PSCO takes, the longer time and heavier burden owner should face. Therefore, it is recommended for owner to be fully educated on criteria of PSCO’s 1st and 2nd inspection.

G4S: Where do you see the market is going in terms of timeframes and vendors competition in the short term? Should we expect more type approvals within the IMO and/or USCG in the short term?

PJK: It is proper to expect more type approvals within the IMO and / or USCG by 2018 but from 2019 when BWMS retrofit will commence, ROI (Return Of Investment) will govern the market trend.

Owners who want to trade into US waters or to have fully qualified BWMS shall apply US type approved system but the others who only need to purchase cheaper system can apply IMO type approved system.

However, as like US Coast Guard type approval requires high investment, new G8 type approval will also request similar amount from BWMS maker. Therefore, the market will be led by BWMS makers who can bear 5~10 million US dollars investment leaving the others unapproved systems.

G4S: What is your key message to industry with respect to BWMC implementation?

PJK: My key message is “Postponement is not an insurance.”

As answered in the first question, BWMS retrofit is unavoidable for 85% of owners and as everyone knows demand concentration during 5 year periods, cost for BWMS, materials (pipes and cables mainly), repair shipyard cost, manpower cost, supervisor cost and even class inspection cost will be increased.

Right before those facts, the most logical, efficient and cost saving way is to avoid 5 year periods which means early BWMS retrofit by the year of 2019 which can guarantee cheaper cost in all sectors.